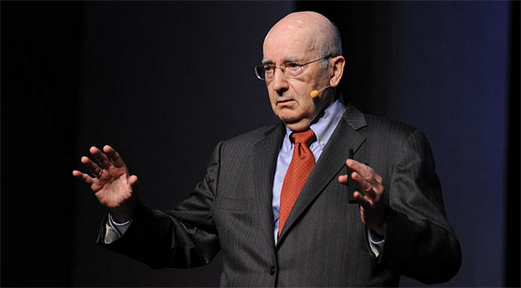

The International Economic Outlook with Dr. Dambisa Moyo

| I am inspired by the idea of striving to embody a different – more positive narrative – around what is possible for anyone, everyone, and anywhere. | |

| |

| You have a fascinatingly varied background when it comes to life and academic experiences. How has your background influenced the way you approach your work? |

| My approach to work consists of hard work, focus and discipline. In many ways, my life has unfolded before me but I have had to be alert to potential opportunities and open to positive energy and support wherever it would come from. I benefited tremendously from growing up in a home where my parents instilled in their children that “anything is possible.”

This has been at the core of my approach that has helped me go from Africa to Harvard, a PhD in Economics at Oxford, Goldman Sachs, a New York Times bestselling author, and on to the many corporate boards that I serve on today. I am inspired by the idea of striving to embody a different – more positive narrative – around what is possible for anyone, everyone, and anywhere. |

| For some time now, media outlets have buzzed with fear and speculation over China’s slowing economy, particularly after recent stock market drops and currency devaluation. How would you describe the current state of the Chinese economy? |

| Like many countries, China is facing a number of significant challenges – both in the short term and long term - pollution, environmental concerns, demographic shifts, urbanization and the recent volatility in the economy. However, despite clear worries of China's growth prospects, the country’s GDP estimates remain close to 7 percent - the minimum annual rate of growth required to double per capita incomes in one generation.

Of course, there are warranted concerns of the broader reverberations of a China slow-down across the rest of the world, which has been highly dependent on China for trade, foreign direct investment and loans. However, China's economic transition from an investment to consumer based economy was never going to be linear, and although the path will be volatile, China's political class has thus far proven astute at navigating uncertainty. |

| What actions do you expect Chinese policymakers to take as we proceed through the year? What effects would these actions have on world markets? |

| Like many other economies (the US, Eurozone, Japan) China’s policymakers will likely employ more aggressive monetary policy (quantitative easing, cutting interest rates, and lowering reserve requirement ratios) to stimulate investment and consumption rather than savings, and fiscal policy interventions (increasing stimulus package) to boost public spending. Given the prevailing volatility in the global financial markets, stalling global growth, and China’s central role in trade, investment and capital flows around the world, China’s policy makers will likely increase their public communication and articulation of their economic policy and goals. Such efforts will help allay global investor’s fears and offer greater clarity on China’s growth path. |

| Even with the recent market volatility, China is still displaying notable economic growth and continues to increase in global influence... | |

| |

| What advice do you have for investors in Chinese markets or people who are considering investing in Chinese markets? |

| Even with the recent market volatility, China is still displaying notable economic growth and continues to increase in global influence – as demonstrated by the introduction of the Chinese renminbi into Special Drawing Rights at the IMF and its leadership of the Asian Infrastructure Bank. From an investment perspective, this, coupled with the sheer scale of the country’s population, makes China an attractive investment destination.

China’s state capitalist economic system and political stance of deprioritizing democracy, places an onus on investors to better understand the country context. As China’s political class continues to grapple with many of economic challenges typical of developing countries (lack of quality education and healthcare, disease epidemics and extreme poverty), investors will benefit from taking a longer term investment view. China’s efforts to build free trade zones, along with improved infrastructure, traffic, logistics industry and high-quality human resources also continue to make China’s investment environment attractive. |

| In a recent interview in The Sunday Times you commented on the outlook for the U.S. economy, saying: “We live in a global world. It’s hard to see a situation where the U.S. can just continue to charge along.” How might global trends and/or events slow down the U.S. economy this year? |

| Despite some of the recent constructive data in the US economy - particularly with the US consumer and in the housing sector- the global economy continues to struggle to emerge from the weight of the financial crisis and remains in a precarious place. Many industrialized economies are still creaking under mounting debt, facing challenging demographics, and stagnating productivity. Meanwhile, the world's leading emerging countries – such as Brazil, Russia and South Africa, and the developing country region as a whole - home to 90 percent of the world's population and where, on average, 70 percent of the population is less than 25 years old – is dealing with an unprecedented economic slowdown and even regression. The risk of contagion via collapsing trade, weak commodity markets, falling (Chinese) foreign direct investment and international debt (fueling concerns of a sovereign credit crisis) could engulf the US economy.

Additionally, the US dollar remains relatively strong which could increasingly act as a drag on exports. Moreover, geopolitical tensions and challenges – from refugees and the migrant crisis in Europe to terrorism to in the Middle East (demonstrated by the rising tensions between Saudi Arabia and Iran) – are disconcerting and given global interconnectedness of global commerce, financial, and immigration flows, the US economy and markets will continue to be impacted. |

| The new US president will preside over the largest economy at a time when the global economy is stalling. | |

| |

| What are some steps that the next President of the U.S. would have to take to create a more sustainable model of economic growth? |

| The new US president will preside over the largest economy (with a GDP of over US$15 trillion) at a time when the global economy is stalling. In order to create a more sustainable model of economic growth, US public policy will have to focus on both short-term and long-term policies. Short-term policies will continue on monetary (an accommodating low interest rate environment) and fiscal interventions that manage the market gyrations, stabilize the economy and attain full employment, and long-term interventions focused on investing in quality education, infrastructure and retraining the population in a digital age. |

| Looking at global markets, where do you see some of the biggest opportunities for growth this coming year? |

| Despite the overarching global economic malaise, and volatility in the financial markets, there are opportunities for investors in different sectors, regions and across different asset classes. For example, sectors such as food (across the range of producers to supermarket chains), technology and transportation and logistics will all benefit as they are necessities. Investment in emerging economies across South America, Asia, and Africa will benefit as their populations continue to grow and these countries continue to develop and converge to higher living standards, albeit at slower growth rates. Among asset classes, commodities, such as oil, gold, copper and iron ore are trading near historical lows, and as such may offer an attractive investment opportunity. |

| Political risks could emanate from the US election, the UK referendum on remaining in the European Union, as well as political risks from radicalized terrorism (such as ISIS). | |

| |

| Where do you see some of the biggest risks this coming year? |

| The biggest risks this year relate to economic and political risks. Economic challenges include the on-going China slowdown and concomitant contagion effects to emerging economies (China related trade and FDI decline), further price deterioration in commodity markets, and sovereign debt crises as governments struggle to repay debt, as well as economic recession in developed economies.

Meanwhile, political risks could emanate from the US election, the UK referendum on remaining in the European Union, as well as political risks from radicalized terrorism (such as ISIS) and mounting social unrest which has been recorded in numerous countries such as Brazil, Russia and South Africa recently. |

| One of your duties on the corporate boards you serve is overseeing corporate social responsibility (CSR). How does CSR benefit the companies that practice it? |

| Ensuring that CSR is part of the company’s core culture contributes to better employee morale, customer loyalty, and a more positive public image, among other things. CSR is at the heart of business and cannot be seen as distinct from it. Internally, CSR benefits companies by supporting /creating a happy, healthy workforce where people are productive and motivated.

Externally, businesses must create value for shareholders and maximize opportunities of business in a social responsible way if they want to thrive in the 21st century. Stakeholders and consumers increasingly expect more from companies and simply producing profits is not enough to make a business stand out and succeed. |